IMPACT OF INCREASE IN REPO RATE ON REAL ESTATE SECTOR

The decision to raise the Repo Rate by The Reserve Bank of India came as a surprise. The increment by 25 basis points has the housing sector worried. The interest rate of deposits and lending has already been hiked by numerous banks. Even though the central bank has revised certain criteria for housing loan limits it is not going to cheer up the parties involved in real estate sector.

Before we go ahead, let’s understand what is ‘Repo Rate’?

Let us first begin by understanding what ‘Repo Rate’ is. To simplify the concept, repo rate is basically the rate at which the central bank of a country loans out money to various commercial banks in case of funds shortage. In case of India, the Reserve Bank of India uses repo rate to control inflation. The implementation of such action reduces the supply of money in the economy thus abetting the impact of inflation. Recently, the repo rate in India was raised.

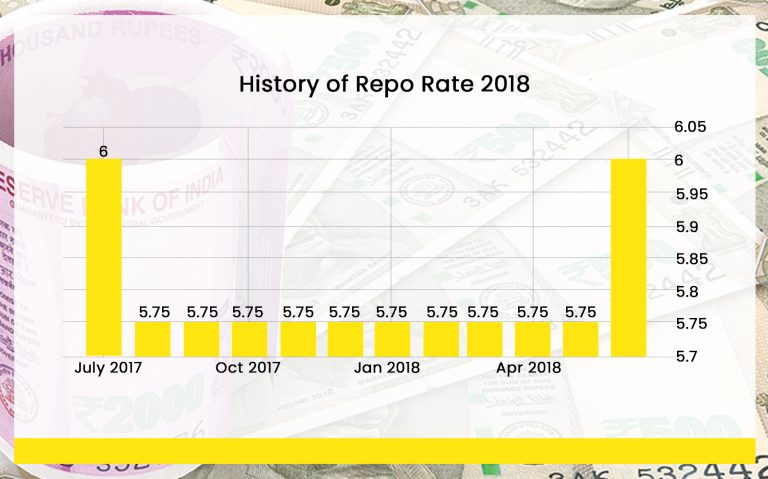

After nearly half a decade, the Reserve Bank of India [RBI] raised the benchmark repo rate to 6.25% by 25 basis points [bps]. Last time the repo rate was hiked [January 2014], it went up from 7.75% to 8%. This sudden hike highlights the turning of the interest rate cycle, even though the rates on loans and deposits have been climbing for quite some time now. Since 2015 the interest rates have had a gradual fall up until August 2017 which saw the last rate cut.

Why the sudden raise in rate?

It came in as a surprise to a lot of professional analysts who were not expecting any change in the current repo rate. Chief economists at CARE Ratings, Madan Sabnavis, proclaimed that it was an unexpected move by the RBI. According to him, insiders were not expecting new changes any time soon. Due to the move, it can be interpreted that the RBI expects the inflation to go north hence, they have gone for a rate hike and a neutral stance.

This sudden monetary policy was implemented by the RBI in order to keep control over Consumer Price Index [CPI] inflation. Over the past few months the Consumer Price Index has been going up. Adding to inflationary pressure, crude oil prices have risen a lot since the last policy meet in April. Crisil’s chief economist Dharmakirti Joshi is of the opinion that various indicators like inflation expectation surveys, crude prices or exchange rate depreciation were already pointing towards inflation risks. Thus it was a reactionary move made by the RBI to contain inflation.

How does the increase impact you?

The evident impact would be increased interest rates. Over the past few months a multitude of banks have been increasing the rates on lending and deposits; the recent one being just a couple of weeks ago. As per Sabnavis [Chief economists at CARE Ratings], a few banks have already raised the marginal cost of funds-based lending rate. This will cause the cost of borrowing to go up. To complicate the situation, banks will also hike deposit rates and it will be good for savers.

In the past, banks have been actively passing rate hikes to borrowers. The transmission though was discouraging when the rates took a dive. For example, the Reserve Bank of India diminished rates by 125 bps, while banks cut rates by only 60 to 70 bps, bringing into light a lack of full transmission. In its monetary policy reviews, the RBI has flagged this particular issue in the past as to how the rate cut benefits were not being passed on to the actual customers.

Crisil’s chief economist Dharmakirti Joshi has said, “Even without the RBI move, there was a de-facto rate hike in the system in G-Secs, corporate bonds, bank MCLR and deposit rates, all of these were anyway rising.” It cannot be established with utmost certainty whether or not the banks will immediately change the lending and deposit rates as they, along with the market, have already included the rate hike.

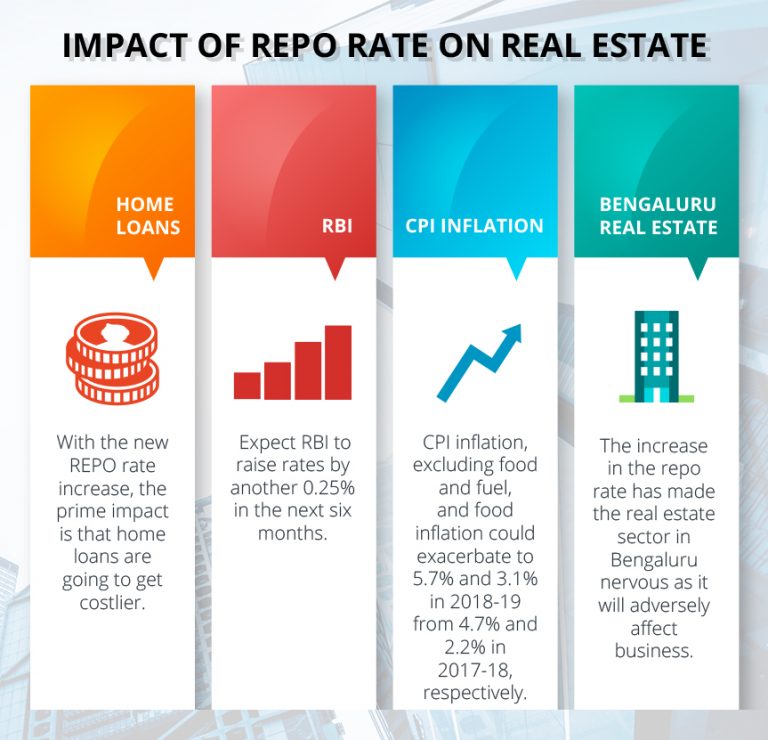

Brace yourself for this might just be the first hike in a series of hike to be implemented. Sameer Narang, chief economist, Bank of Baroda, has said, “As a result, we expect RBI to raise rates by another 0.25% in the next six months as inflation is likely to remain above RBI’s target of 4%. Further policy action will depend on movement of oil prices, rupee and government’s MSP policy.” He has specified that CPI inflation, excluding food and fuel, and food inflation could exacerbate to 5.7% and 3.1% in 2018-19 from 4.7% and 2.2% in 2017-18, respectively.

Impact on real estate?

The increase in the repo rate has made the real estate sector in Bengaluru nervous as it will adversely affect business. With the new REPO rate increase, the prime impact is that home loans are going to get costlier.

National President of Confederation of Real Estate Developers’ Association of India (CREDAI) Jaxay Shah has said that interest rate hikes could result in “suppressed growth” in the Indian real estate sector.

The CEO of Paisabazaar.com, Naveen Kukreja advices new home loan borrowers to diligently compare the interest rates offered by various lenders before making the final decision as home loan rates differ across finance companies.

Solutions for Real Estate Woes

The central bank revised the eligibility criteria for low cost housing on 6th June 2018 from Rs 28 lakh to Rs 35 lakh in metro towns with a population of 10 lakh and above. For other centers, the central bank cut loan rates from Rs 25 lakh to Rs 20 lakh. At the end of June a circular is scheduled to be issued.